How’s your side hustle going?

It should be going GREAT since I showed you the buying opportunity that SPY was giving you as it dipped down to its rising 20-day moving average the other day.

The question now, however, is where does the market go from here?

Ever since retail traders showed evidence that they were panic selling late last year, it’s pretty much been a straight line higher for SPY in 2023.

Unfortunately, we are starting to see signs that the market may be getting a little too bullish.

After 20+ years of teaching folks like you how to trade these crazy markets, trust me when I tell you that THIS is when you need to learn how to sift through the noise of all the talking heads to see if the trend has what it takes to continue.

Here’s what I mean.

Sentiment is a powerful trading tool.

Wall Street’s biggest traders and institutional players love to wait patiently for periods of extreme fear and greed to enter the market so that they can take the other side of the trade against uninformed retail traders (don’t be one of them!).

Sometimes, however, periods of fear and greed can persist, so I make it a point to teach my Market Navigator members how to decipher between major market reversals and simple pauses.

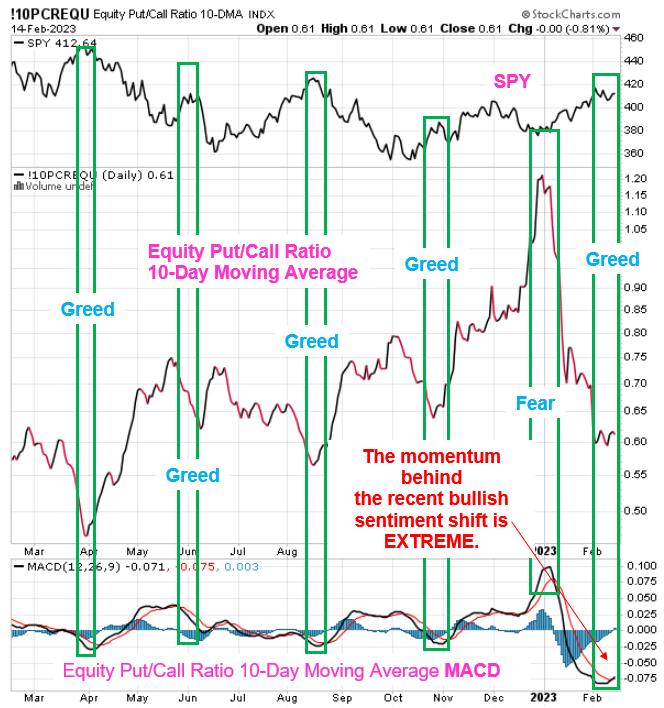

With this next chart, I am about to let you in on a CRITICAL part of the analytical process that I go through with my Market Navigator members when sentiment is near extremes.

What this chart shows in the middle panel is a 10-day moving average of the Equity Only Put/Call ratio. Specifically, it is showing the level of Put buying divided by the level of Call buying.

When the ratio is at high extremes, it signals extreme fear as the amount of Put buying FAR EXCEEDS the amount of Call buying, which you can see was the case late last year (see SPY chart in top panel).

At the other end of the spectrum, when the level of Call buying far exceeds the level of Put buying, it is a sign that greed is becoming extreme.

Recently, the MACD study at the bottom of the chart shows us that the momentum behind the recent Call buying has become so extended that traders now need to be on the lookout for a possible pause in the rally.

Like I said earlier, this is not necessarily a great timing tool for telling traders when to get in and out of the market.

But it is great at telling us when we need to be careful about simply piling into the existing trend, which is STILL higher for SPY.

Now, I don’t want to put too much on your plate today by showing you another KEY ratio that I am using RIGHT NOW to gauge the strength of SPY’s trend.

But I will tell you that this indicator is giving me important insights into the strength of the market’s overall risk appetite.

If you are ready to make your next side hustle trade, I urge you to come see how I am using my 20+ years as a trader and market educator to position RIGHT NOW.

As one of Inc.’s most TRUSTED educators, I hope you’ll recognize the value in how I help folks like you plan and place trades in a way that fits your lifestyle.

Over the past two years I have seen many of my Market Navigator members take on trading as a side hustle, with all the extra time they’ve found with their new hybrid working arrangements.

As an innovator in this industry, RagingBull has THE BEST platform for getting trade ideas in front of retail traders from every angle, at all hours of the day.

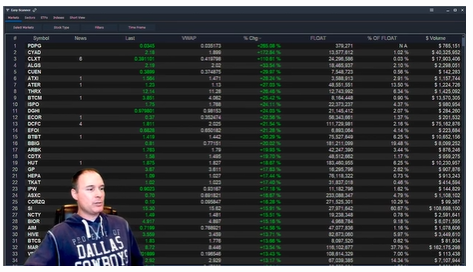

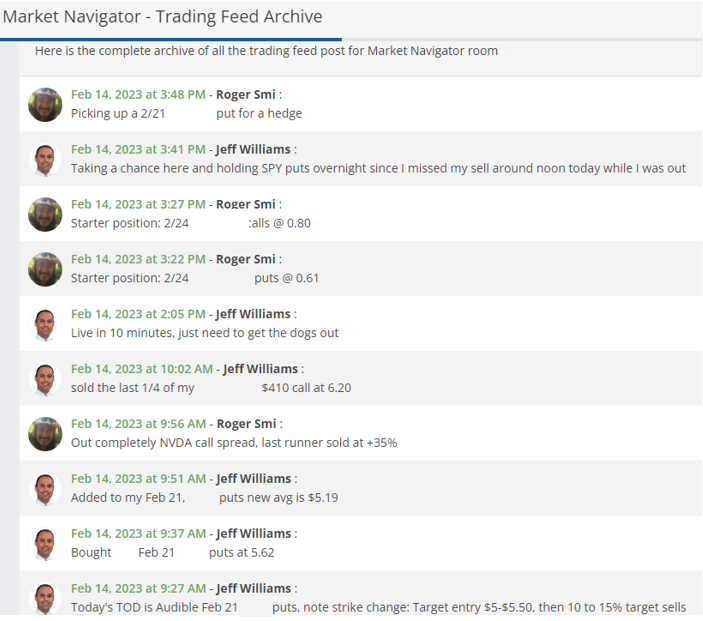

Just look at this SMALL sample of alerts that came from my Market Navigator service alone yesterday:

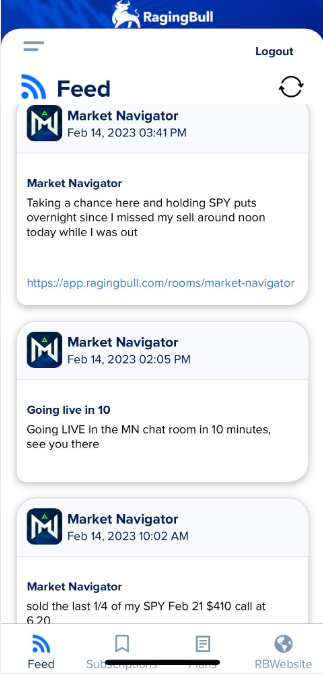

From instant app alerts…

To the LIVE chat room…

To the Market Navigator trading feed…

To non-stop email alerts…

Even if it’s for one trade a day during your busy schedule, there is always an opportunity to quickly take the plan I have hand-crafted for you and execute on it.

I beg you, don’t be another retail trader that falls victim to HORRIBLE market timers like Jim Cramer.

I’ve been trading for 20+ years, and I am about to drop my next trade idea based on what I am seeing in the market’s risk appetite.

Access to EVERYTHING you need to get started is right HERE!

I’m not holding anything back.

- My Daily SPY Trade of the Day Member-Only Email

- The Trade of the Day: ONE stock (SPY) at ONE time (9AM ET)

- Alerts via the RagingBull App

- My Elite Educational Suite. New or experienced, there’s virtually nothing you cannot learn about trading from me. This alone is worth double your enrollment rate. From options terminology to my favorite two chart patterns, this is where the fundamental learning takes place.

- The Market Navigator LIVE trading room, where I put my own capital to work while teaching and trading with members – every trade paired with a pre-alert so you can immediately benefit first!

Every Trade of the Day comes with a 30 minute “HeadsUp” and can be made from your phone.

So if you do have a smartphone, I have your trades of the day…

Easy as that. Don’t miss another day – start your trading journey with me TODAY!