Good morning.

For those of you considering taking advantage of this sale before it expires, I thought you might like to read what the $2,000 Small Account Journey daily newsletter looks l like. Here’s last night’s email to premium subscribers.

Apply Coupon Code: 10dayEMA

And save 30%

Tonight’s charts are from FINVIZ and show Keltner Channel +5 ATR as well as the Relative Strength Index.

Today’s NVDA bear calls went well.

Using the Keltner Channel +5 ATR lesson (watch) I was able to get in the $10 wide at $3.47 and out at $2.45 for a nice +29% +$510 win.

A few hours later I entered the same trade at $2.90.

As I type NVDA is down $10 from the close so maybe another win overnight if this holds up.

My TSLA -$185 / +$180 bull puts at $1.60 expiring next Friday didn’t start as well. Shares closed between strikes and that was fine by me.

The RSI here is so depressed I just don’t see this going much lower before some form of a bounce happens. You just don’t see a 17 RSI on TSLA often and when you do, it tends to bounce for at least a month or two.

TSLA is trading up $1 in the after-hours so this is going in the right direction.

NOTICE: While I’m on that point. You tried Small Account Journey and you liked it. You might just like more RagingBull services. Which is why we’ve created an 8 service bundle for just $1,299. It saves you over $3,000 even from our discounted prices. The way I see it, you subscribe for a year and see which are your favorites. Then continue with those. But at 70% off, we can only offer this to 50 45 more subscribers.

My view of the market is neutral to slightly lower so expect more bear calls for now.

I’d like to see the QQQ come down to the 10-day EMA or Keltner Channel mean to shake some of these names that are far above their 10-day.

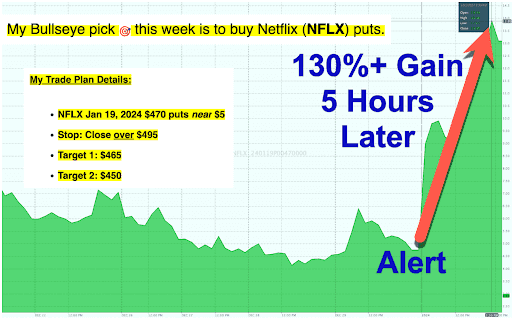

My watchlist is NOW, SNOW, LULU, TSLA, NVDA, META and NFLX. My focus is bull puts but at the moment I’m trying to be balanced 1:1 bull puts to bear calls.

-

Current Balance: $2,000 – $10,572 or 429%

-

Dates: November 13 – present

-

Win Rate: 41 wins out of 47 trade alerts

It’s always important to reiterate that I cannot speak for my members’ performance, as results may not be typical and trading is hard. And I cannot guarantee you will make money. But what I can guarantee is that I will work my butt off to teach you why I trade what I trade.

Benchmarks:

-

$2K-$5K 100% allocation to get the account up in value fast

-

$5K-$10K 50% allocation (up to 2 $2.5K-$5K trades open at a time)

-

$10K-$20K 25% allocation (up to 4 $2.5K-$5K trades open at a time)

-

$20K-$100K 15% allocation (up to 7 $3K-$15K trades open at a time)

-

$100K+ is 10% allocation (up to 10 $10K+ trades open at a time)

Lessons:

Guidelines:

-

Tickers: best co’s in world, earnings winners, strong guidance

-

Order type: bull put (neutral to bullish i.e. good co’s tend to go up)

-

Target entry: 1-2 strikes below price and defined by technical analysis (sell below big support to boost odds)

-

Entry (credit) goal: 30% of the spread width i.e. $10 wide = $3, $5 wide = $1.50

-

Exit (debit) goal: 30% if achieved on day 1-2, otherwise 50% of the credit

-

Stop loss strategy: defined by sold strike (conservative) or bought strike (liberal)

-

Allocation: starts at 100% and works through 5 benchmarks to diversify risk as the account grows

-

Expiry: 2-3 weeks from expiration (conservative) or 5-7 days from expiration (fastest rate of decay)

My strategy or edge stacks probability. Just like bookmakers (DraftKings), casinos (MGM Grand) and insurance co’s (Geico) do daily.

$2,000 Small Account Journey probability stack:

-

Great companies like Apple trend up over time

-

Short put vertical spreads have high probability of profit

-

Focusing on earnings winners increases odds

-

Short put vertical spreads have 3 ways to win

-

Bullish chart patterns and 10-day EMA allows for precision entries

-

The buyers put options decay the fastest 5-7 days before expiry

-

Taking 30-50% wins quickly increases odds of winning

Jason Bond

DISCLAIMER: To more fully understand any Ragingbull.com, LLC (“RagingBull”) subscription, website, application or other service (“Services”), please review our full disclaimer located at https://ragingbull.com/disclaimer.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. AnyRagingBull Service offered is for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation, or be relied upon as personalized investment advice. RagingBull strongly recommends you consult a licensed or registered professional before making any investment decision.

RESULTS PRESENTED NOT TYPICAL OR VERIFIED. RagingBull Services may contain information regarding the historical trading performance of RagingBull owners or employees, and/or testimonials of non-employees depicting profitability that are believed to be true based on the representations of the persons voluntarily providing the testimonial. However, subscribers’ trading results have NOT been tracked or verified and past performance is not necessarily indicative of future results, and the results presented in this communication are NOT TYPICAL. Actual results will vary widely given a variety of factors such as experience, skill, risk mitigation practices, market dynamics and the amount of capital deployed. Investing in securities is speculative and carries a high degree of risk; you may lose some, all, or possibly more than your original investment.

RAGINGBULL IS NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Neither RagingBull nor any of its owners or employees is registered as a securities broker-dealer, broker, investment advisor(IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization.

WE MAY HOLD SECURITIES DISCUSSED. RagingBull has not been paid directly or indirectly by the issuer of any security mentioned in the Services. However, Ragingbull.com, LLC, its owners, and its employees may purchase, sell, or hold long or short positions in securities of the companies mentioned in this communication.

RagingBull.com, LLC shall be entitled to recover attorneys’ fees, costs and disbursements. In the event that any suit or action is instituted as a result of doing business with RagingBull.com, LLC and/or its affiliates or if any suit or action is necessary to enforce or interpret these Terms of Service, RagingBull.com, LLC shall be entitled to recover attorneys’ fees, costs and disbursements in addition to any other relief to which it may be entitled.